Award-winning PDF software

Form 14654 for Maryland: What You Should Know

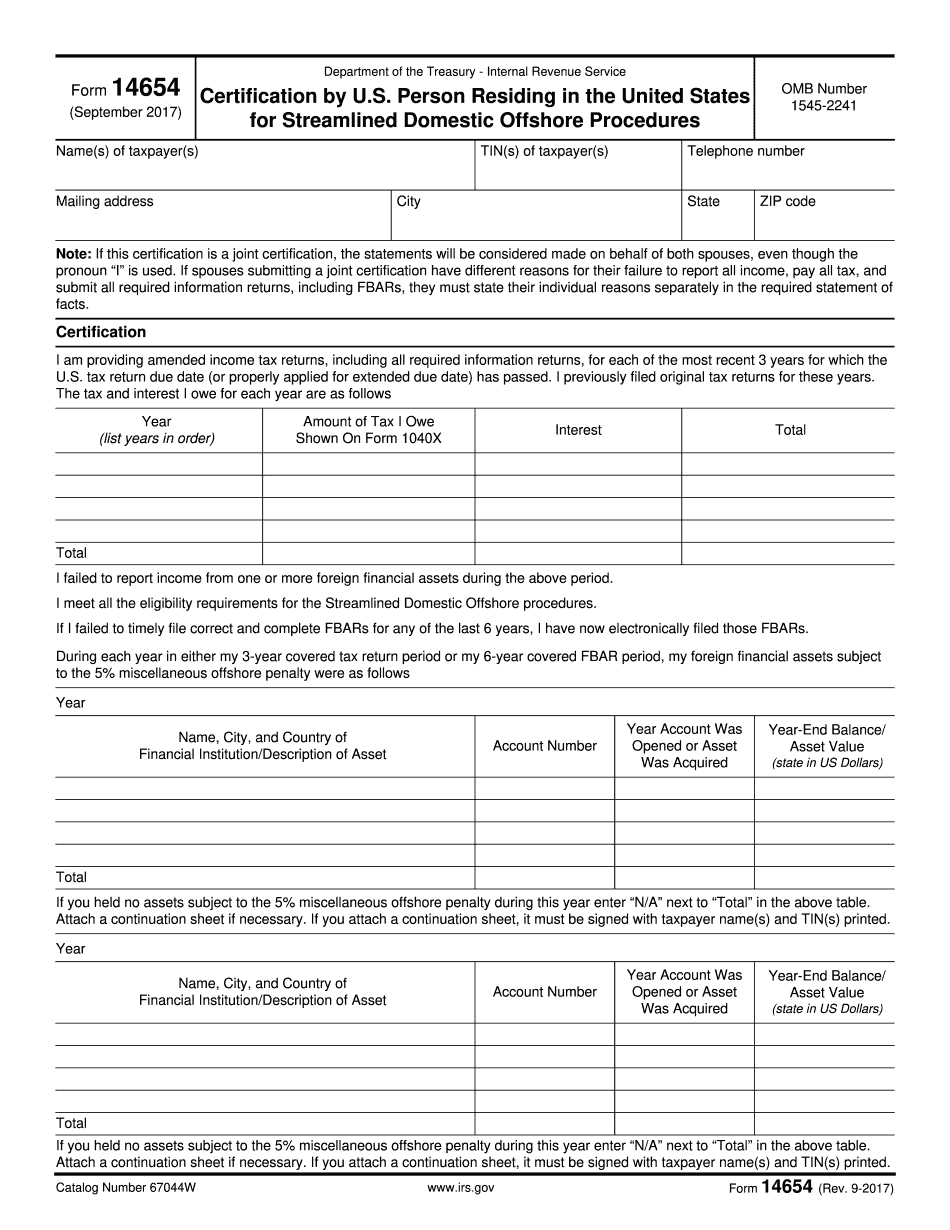

The Taxpayer's] income, source of income, tax benefits are the information for which taxpayers should report in the Streamlined Forms. Advisors are charged with monitoring and analyzing the information reported ensuring that it is reported in its correct form. The Streamlined Forms may then be revised based on the analysis of the information reported and any follow-up information obtained. [TIP] Advisors advise that the Filer may obtain a signed, sworn Statement form by completing Form 14654-A, Streamlined Statement of Income, Source of Income and tax Benefits. This Statement will be used to confirm the accuracy, if any, of the information reported on the Form 14654, and to determine any adjustments which are to be made to bring the income to the source of income on the Form 14654. The Statement will also be used to assist in identifying additional tax benefits which may be claimed on Form 14654, if any. [TIP] If a taxpayer makes an incorrect statement on the Form 14654, the Advisor must make any corrections provided in the Statement. In order for the error to be corrected, the error should be explained to the advisor so that it can be corrected. The errors in the Form 14654 may be corrected as long as all the requirements of 1404 are not violated. [TIP] If a taxpayer does not comply with the requirements of 1404, they may be subject to interest on the taxpayer's failure to report an income or a source of income, or to make a tax benefit claim. [TIP] If the taxpayer does comply with the requirements of 1404, the taxpayer will not be charged tax for filing false documents. [TIP] If the taxpayer willfully or negligently violates the Streamlined Procedures, the Advisor may consider the filing of an information report or assessment of tax claims for tax year 2024 for the same filing period where the filing of Form 14654, or any part thereof, was not made and where tax was not reported. [TIP] Note: The Streamlined Form 14654 is due on the due date printed on its face (the date of mailing or deposit of the completed Form 14654). [This information must be filled in before filing Form 14654.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form 14654 for Maryland, keep away from glitches and furnish it inside a timely method:

How to complete a Form 14654 for Maryland?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form 14654 for Maryland aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form 14654 for Maryland from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.