Hey Anthony, hello Claudia. Today, we're talking about federal tax amnesty for 2016. That's right, but there really isn't federal tax amnesty. Yeah, that's one of those things. Man, people keep searching for this term and it's what they call our office to say, "I'm interested in a federal tax amnesty program," and it really isn't such a thing. I think where the confusion comes from is states. Because state revenue agencies are usually always running some sort of tax amnesty program, yes, it makes sense when you think about what they were doing. If you look at, you know, I've looked at a lot of the bills the states put in, they say, you know, I'll tack the legislators and get together to say, "We need to have a tax amnesty to raise revenue and give people a fresh start, a clean fresh start." And so they all talk about it like, "Yep, this is going to increase our revenue if we do this tax amnesty. Like we've had people who haven't paid taxes in a long time, if they, you know, usually the tax amnesty is like, it doesn't matter what your ability to pay is, right? As long as you pay this amount by this date, you know, they won't prosecute you criminally and they're going to give you a break on your taxes. It has nothing to do with your ability to pay. If you could afford to pay the whole thing, you don't have to, and that's kind of how those tax amnesty works, all right? And they're a one-time thing because you can't run a tax amnesty every year. Yeah, every January, just wait till, you know, I wait for the amnesty in 20 years and then I'll come clean. So you only could...

Award-winning PDF software

Irs amnesty program Form: What You Should Know

Foreign Accounts — If you reside in a foreign tax jurisdiction, then there is an additional requirement: If you reported an account to the IRS as Foreign Assets, Interest, Royalties (or similar tax) in the United States, you will need to file a Foreign Account Report (FAR). FAR Filing Instructions — IRS FATR form is the official documentation required by IRS for taxpayers who own or maintain foreign accounts. Under current U.S. Tax Law, if you fail to file a FAR and pay tax on your foreign accounts, you may be forced to pay interest and penalties to the IRS. Online filing — FICA, FTA, FCO and W-8 FICA, FTA and W-8 forms may be faxed or emailed, and they are available online. There are different ways of filing FICA, FTA and W-8 online through IRS.gov. If you own more than one business, or you are self-employed, you may need to use one or more forms. If your business is taxed in more than one jurisdiction, then you need to file each form on its own, and complete it each year. For example, if you received tax credits in Florida and California, then you may need to file a separate form for each jurisdiction. Forms to be Filed for Filing U.S. Business with IRS The following forms are required for filing a U.S. business. Internal Revenue Code (IRC) Section 56, Internal Revenue Code (IRC) Section 1012, Internal Revenue Code (IRC) Section 1031, Internal Revenue Code (IRC) Section 3305, and Internal Revenue Code (IRC) Section 4972. All FINS forms may be faxed or emailed, and they are available online. Form 56-B is a copy of Form 1040 with Form 5498A as the return (unless amended). Form 56B, Certificate of Compliance (PDF) — Forms 56B and 56G—Form 1040-C (PDF). Form 5469 and Form 5498A (PDF) and Form 5498B (PDF). Both Forms 5498A and 5498B include instructions for electronically filing the form, and it allows a taxpayer who is subject to section 1031 reporting, to file electronically. Form 8889, U.S.

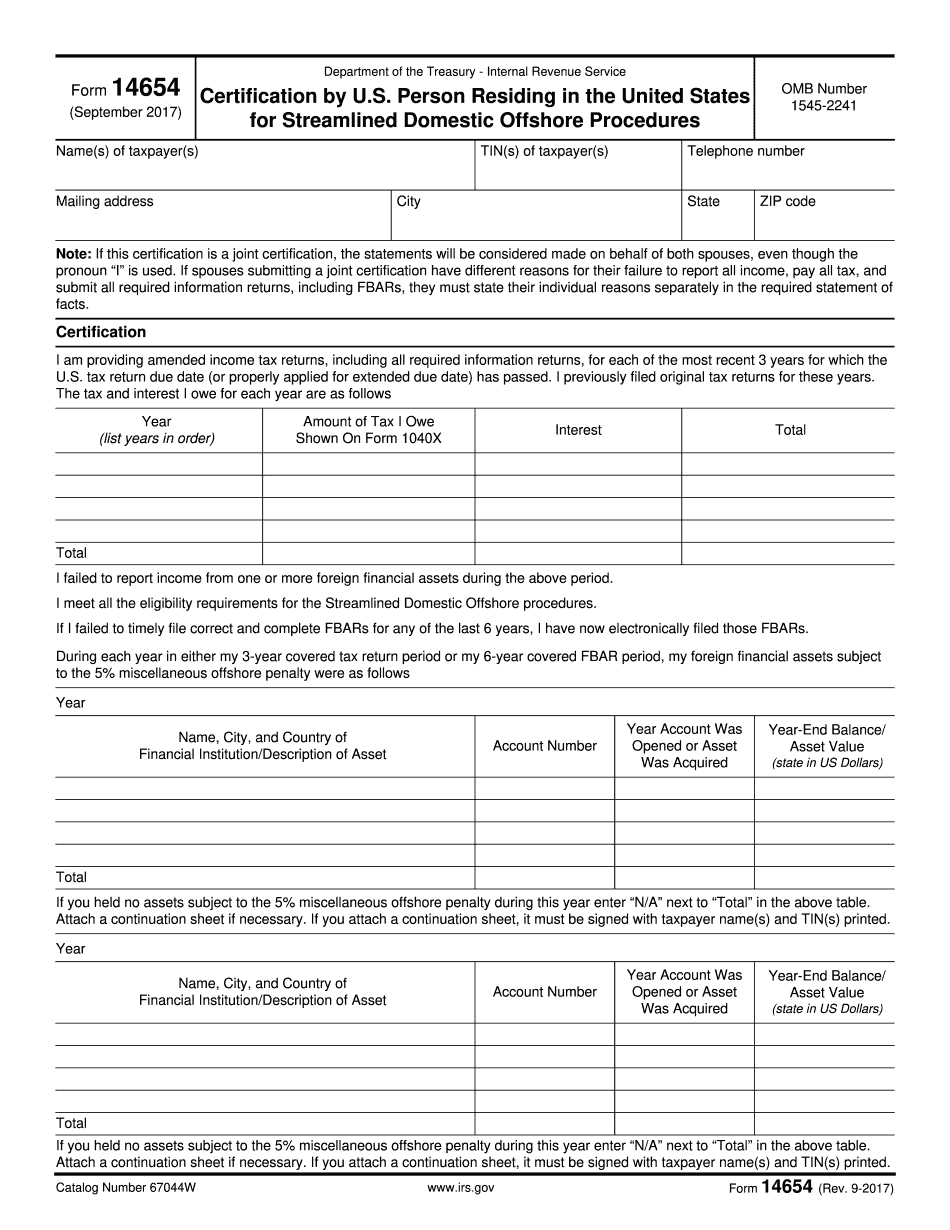

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 14654, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 14654 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 14654 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 14654 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs amnesty program