Hey Anthony, hey Claudine! We're continuing our FATCA series today, and we're talking about penalties. We've mentioned penalties a lot, but they never want to get down until everything just gets better and better. Yes, and now we're going to dive into this topic in our capstone video. We may add more information later as more wonderful things happen. - Our focus today is on penalties for individuals. We started investigating penalties for foreign financial institutions, and it was like going into a rabbit hole. So, we'll do more investigation and then talk about that and its impact. We initially planned to do a video including both topics, but it seems like there's too much information, so we'll keep them separate. - Today, we're specifically discussing penalties related to Form 8938. There are other forms like F bars and Form 5471, each with their own penalties. We will also go into the statutes of assessment a little bit. - For failing to file Form 8938, the penalty is a quick $10,000, with an additional $10,000 added for each month the failure continues, starting 90 days after the taxpayer is notified of the delinquency. The maximum penalty per return is up to $50,000. This penalty structure is similar to the penalties for Form 5471. - Now, let's briefly touch on F Bar penalties. Some might wonder if Form 8938 penalties include F Bar penalties. The answer is no. They are completely separate, and you can receive both penalties for the same account. F Bar penalties come from Title 31, which is related to the Bank Secrecy Act. The focus of the Act is to crack down on international crime syndicates, not tax evasion. It's interesting to note the history of the Bank Secrecy Act and its intent to address bank secrecy and the movement of...

Award-winning PDF software

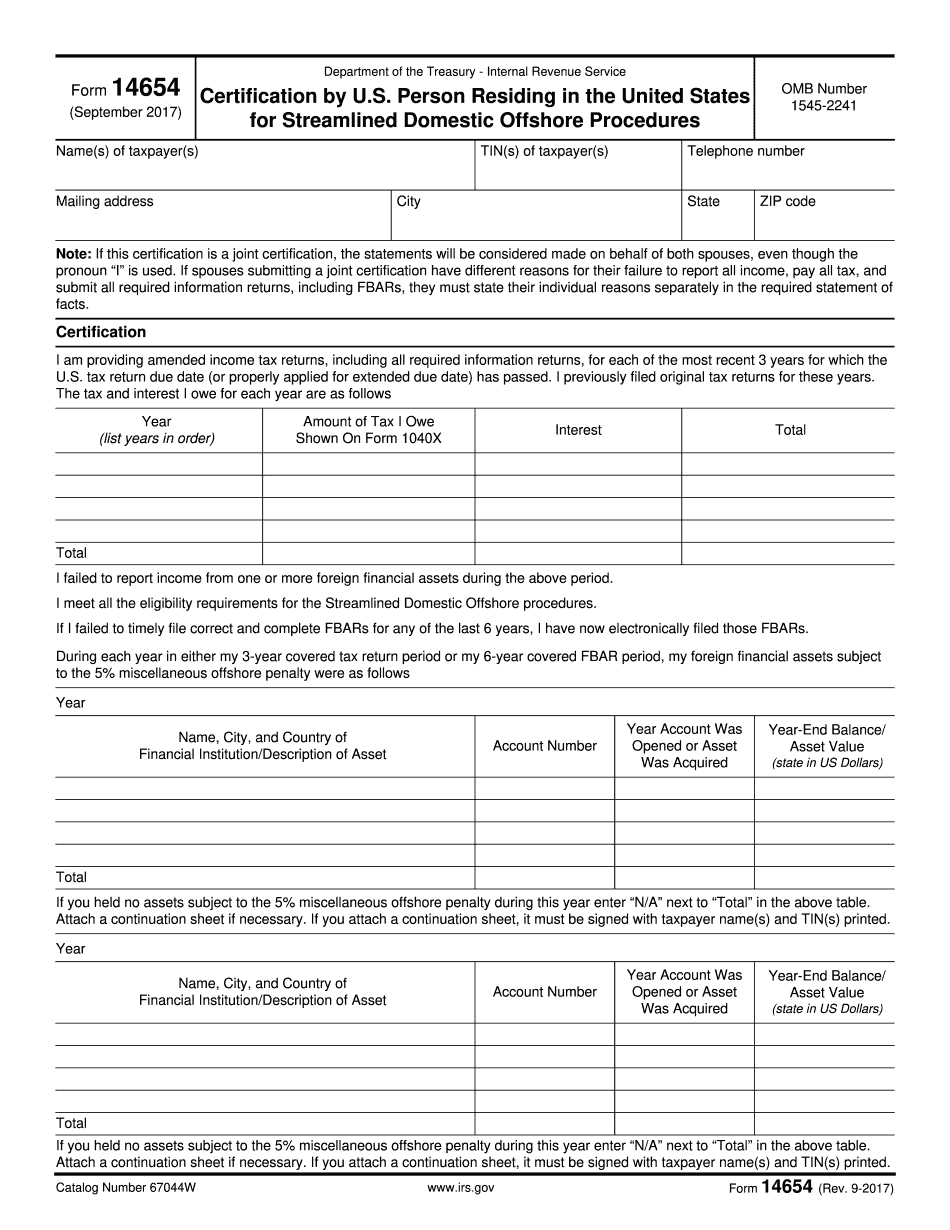

14654 (rev. 6-2016) Form: What You Should Know

Online Form 14654 Fill Online (Form 14654) Dec 13, 2024 – We are no longer accepting the Form 14654 Form 14654 (Annual Tax Filing) (2016). 2 Form 14654 (Annual Tax Filing) (2016) IRS Form 2655 — Filing and Certification/Form 8283 (2017) Filed March 11, 2017. Filed March 17, 2017. IRS Form 2555 — Filing and Certification/Form 8283 (2017). Filed April 3, 2017. Filed April 6, 2017. IRS Form 2655 — U.S. Person Filing and Certification/Form 8283 (2017). Filed April 5, 2017. IRS Form 2555 — U.S. Person Filing and Certification/Form 8283 (2017). Nov 3, 2024 – We will no longer be accepting the IRS Form 2555 (Personal Taxpayer Identification Number) for personal filers using Form 8283 (2017) and are no longer accepting the Form 8283 (2017) for U.S. Person filers, Form 2555 (Personal Taxpayer Identification Number) for personal filers must be on the Form 8283 (2017) and must be filed in the same manner as Form 8283 (2017) Form 2555 -Filing and Certification/ Form 8283 (2017) Dec 25, 2024 – We are no longer accepting the 2017-09 Form 2555 (Personal Taxpayer Identification Number) for personal filers using Form 8283 (2017) and are no longer accepting the Form 8283 (2017) for U.S. Person filers. Form 2555 (Personal Taxpayer Identification Number) for personal filers must be on the Form 8283 (2017) and must be filed in the same manner as Form 8283 (2017). Jan 3-5, 2024 – We are no longer accepting the IRS Form 8283 (2017) for U.S. Person filers, Form 8283 (2017) will not be accepted. This document is for informational use only and does not constitute an offer, solicitation or sale of any securities or any other financial products or services.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 14654, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 14654 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 14654 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 14654 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 14654 (rev. 6-2016)